By Patricia A. Scheyer

NKyTribune reporter

EDGEWOOD

Edgewood city council held a second reading of the tax rates this week. The real estate tax rate was set at .186 per $100 of assessed value, down from last year’s rate of .226 per $100 of valuation. This is a 17.7 percent decrease, which is the largest reduction in the history of the city, as well as allowing the city to be at the lowest tax rate since 1996 when the rate was .180 per $100 of valuation.

“We believe that this continued reduction will provide much needed relief to our community, and hopefully provide more disposable income for our residents,” said City Administrator Brian Dehner.

“We appreciate the support of our residents, and look forward to continuing our work to enhance the quality of life in our city,” said Mayor John Link. “Our staff and city council are always putting fiscal responsibility and quality service delivery as our top priorities.”

Mayor Link was absent at Monday’s meeting, so Council voted to put Jeff Schreiver in the Mayor’s seat for the meeting.

Council discussed the clock in the clock tower at the entrance to President’s Park. CAO Dehner said that the clock needs something, and he wanted to know what Council thought they should do to the clock to make it look better. Councilmember Kim Wolking said it was an eyesore. Other members thought something should be done, but were not sure what. Dehner said since it was the will of the council, he would look into options about what they could do, and how much each option would cost. Most of the council agreed that it should have a coat of paint at least.

NEWPORT

Newport City Commissioners set the real estate tax at $2.15 per $1000 valuation and the tangible property rate at $2.59 per $1000 valuation after a public hearing that began the commission meeting Monday night. This was the first reading of the ordinance. Commissioners also voted on a bookkeeping measure to combine the leases for property owner NOTL on Newport Levee and the Aquarium.

FLORENCE

The city of Florence introduced their new finance director Tuesday evening. Jason Lewis will take over from Linda Chapman, who has been in the position for 21 years. Lewis has a Bachelor of Business Administration with a corporate finance track from University of Notre Dame, Mendoza College of Business, as well as a Bachelor of Science degree in German and International Relations from the United States Military Academy at Westpoint. He is a native of Northern Kentucky, and now lives in Edgewood with his wife Lauren and three kids. His last position was at Proctor and Gamble, where he specialized in budgeting and forecasting, and supply chain analysis.

Council members voted for the second reading of an ordinance setting the tax rates. The real estate tax will be .238 per $100 of assessed value, while the tangible rate will be .241 per $100 of valuation. This is a reduction in the tax rates.

BOONE COUNTY

Boone County Commissioners listened to a resolution cementing the restriction of the extra funds raised by the tax rate last month. The county wants to make sure the extra money definitely goes into a dedicated fund so it can’t be used for anything except road and infrastructure projects.

“This lays out the process that this year we will have our initial allotment of $619,380 plus the currently restricted this year $607,558 placed in that fund,” said County Administrator Matthew Webster. “We had placed the $670,393 in the road fund, we will leave that there for this fiscal year since it’s already there, but next year all three of those pots of money in the amount of $1,897,331 would all be appropriated to this newly designated road and infrastructure fund.”

He said all this money will now be in one place, so that the court can see it.

Recommendations will be made as to which projects will qualify for the money.

Commissioner Chet Hand asked how the funds could be un-restricted, and apparently a resolution voted on by the court could take those funds out of its restricted status.

“The reason I’m asking, theoretically, as an example for the whole discussion on setting the tax rates and everything else, the selling point is that these are restricted funds,” Hand explained. “What happens if we just un-restrict them. Now, it seems like we just went back on what we said we were going to do. Now I’m not saying we would do that, that’s why I’m asking, how would we un-restrict them. Also how do we define infrastructure?”

Webster said the money can only be appropriated for projects that are approved by the court, such as pavement, or a project similar to that on Frogtown Connector road, or because they are still doing the water expansion program, that water could come under the definition of infrastructure. He said projects could be brought before the court for approval sooner than the 2026 budget, because the funds are available now. Webster also stated that the money in that fund is not just from tax dollars but also from grants and such. He said there are three separate buckets of money that have been restricted, and one of those buckets was specifically restricted for water expansion.

Commissioner Jesse Brewer asked if they could get a detailed list of how the money is spent, and Webster agreed to provide that.

The resolution was approved.

Another resolution approved an agreement to partner with the state transportation department to cover 53 miles of state roads in Boone County in addition to the nearly 450 miles they already cover to perform snow and ice services due to personnel and contractor shortages at KYTC. Just like the last few years, the state will pay the county a base service fee of $142,200, and in addition will compensate the county by paying $168.80 per driver hour and $88.55 per ton of salt used. Even though it is an extra burden on the county’s drivers, the court wants the roads to be safe.

Commissioner Hand asked that the county start a process to trade Chambers Road in Walton that is a state road, for Hicks Pike, a county road. He has talked to KYTC, and he said they are open to the idea. Hand said on the surface there seems to be a lot of benefit to the county to be able to control Chambers, and the tunnel and the truck traffic, and benefit to the state for having Hicks Pike, but he doesn’t want to limit options, so he would like to start the process for a study to present the pros and the cons that might occur with such a trade.

Judge Executive Gary Moore said there is a precedent for doing a trade like this, and it makes a lot of sense.

Moore also announced that there is a burn ban in effect in Boone County due to the dry conditions.

INDEPENDENCE

Independence City Council held a special meeting Wednesday evening to pass the second reading of an ordinance setting the tax rates for the year. The new rates are .220 per $100 of assessed value for real estate, and.534 per $100 of assessed value for the tangible rate.

“We are once again keeping the tax rate the same,” said Mayor Christopher Reinersman, “Our last tax increase, we took the compensating rate in 2016. We have not raised taxes since then. We lowered the rate in 2021, and again in 2022 and we are holding with that 2022 rate.”

He brought up the flurry of comments on social media, and noted that certain comments centered on the rise in property assessments. Those assessments are totally under the control of the state, he said, and they are charged with assessing the property at ‘fair market value.’

They do not have the luxury of saying they won’t raise the assessments any certain year, because they have to assess according to the market value. He said he understands that when the market values go up, there is more tax money. The same thing that drives the increase in property value also drives all other expenses to increase, so he made the decision to live within their budget and keep the rate the same.

A resident, Don Lambert, stood up to say he thought the mill rate, or tax, should be reduced at least a percentage. He said ‘don’t put the burden on the shoulders of the homeowner.’ Reinersman asked him how they would cover the increased cost of services. Lambert said there are ways to manage revenue, but then he raised his voice and became combative.

“I feel like we’ve done a darned good job,” Reinersman said, when things had calmed down. “I’m proud of the fact that this council for years has worked hard to keep the tax rate the same. Costs have gone up. At the end of the day we are healthy, we’re going to remain healthy, and we’re not going to ridiculously lowball the budget.”

The ordinance passed unanimously.

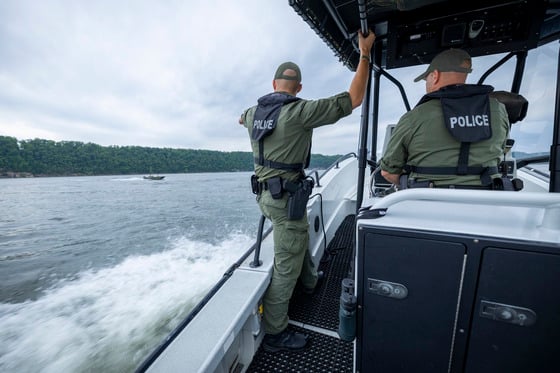

The mayor announced that Officer Ben Bridges is currently in training with the new police pup, Cairo, a canine that was purchased through the Commonwealth Attorney’s Office with confiscated drug money.